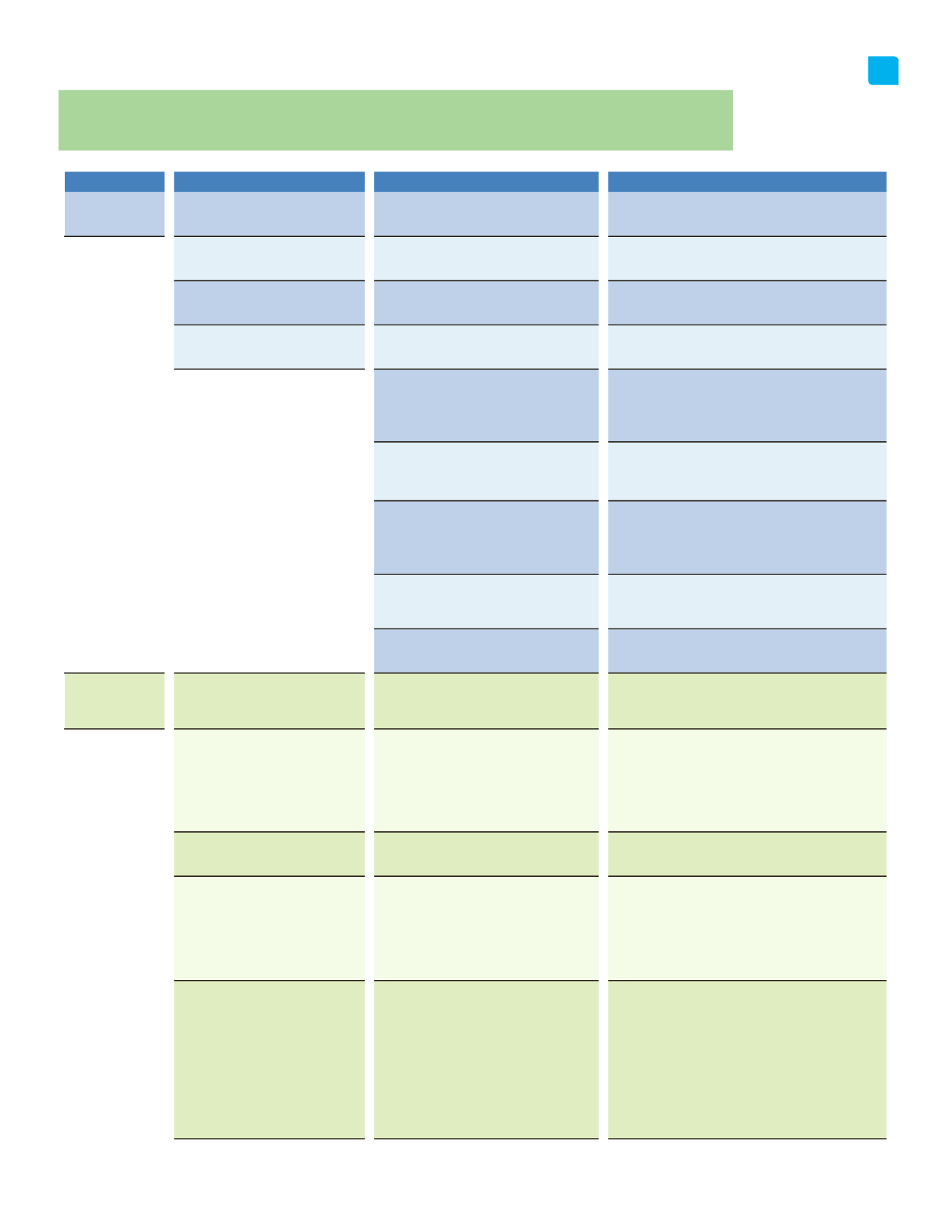

OBJECTIVE

STRATEGY

MEASURE

PROGRESS

Financial Stability

Plan for anticipated

community needs.

Long term Comprehensive Municipal Plan

(CMP) updated annually.

To Council in February 2013.

Fund planned capital expenditures.

Balance CMP without long-term borrowing.

No long-term debt required in 2013 CMP.

Build reserves for

unanticipated community needs.

Have Unrestricted General Reserve Fund

balance of $10 million by 2015.

2013 closing balance of $9.5 million. CMP includes an

annual allocation to the Unrestricted Reserve.

Maintain a reasonable

tax burden for taxpayers.

Tax rate increase similar to rate increase of

other local governments.

Chilliwack's 2013 tax increase was 3.44%, Abbotsford

was 2.06%, Maple Ridge 3.25%, and Langley 2.79%.

Chilliwack remains at the low end of

municipal taxation on a representative home

when compared to similar communities in

the lower mainland.

Only Surrey has lower taxation than Chilliwack, of the 19

communities surveyed. With Utilities and Other Gov't

levies included, Chilliwack is lowest.

Chilliwack remains at the low end of business

taxation when compared to similar

communities in the lower mainland.

Chilliwack has the lowest class multiplier of 19

communities surveyed.

Other revenue opportunities explored.

Available Government Grants applied for. Received

$3,564,733 for the Bailey Landfill Gas Extraction System

project under the RSP Gas Tax Program. Applying for

the next round of flood infrastructure grants.

Identify priority projects that will be eligible

for infrastructure grants and save for

municipal portion.

Incorporated a savings plan into the 10 Year Financial

Plan for 1/3 funding for the Collinson, McGillivray and

Hope River drainage pump stations.

New growth pays for itself.

DCC Bylaw reviewed and rates amended. Full cost

recovery analysis prepared.

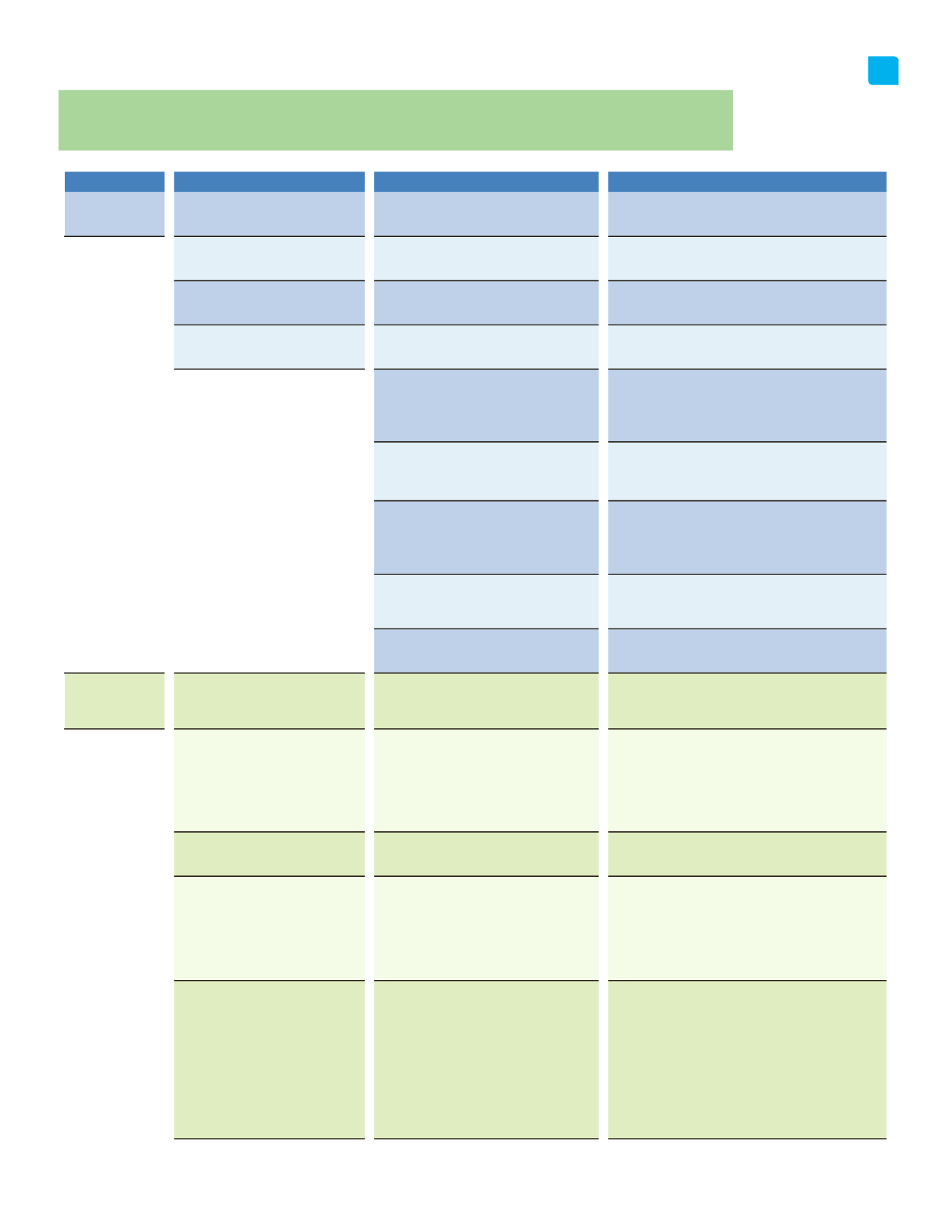

Good Stewardship

of Municipal

Infrastructure

Maintain the road system.

Average pavement quality index goals set at:

Arterial 6.5, Collector 6.0, Local 5.5.

Investment into road rehabilitation program has been

increased to $2.875 million in 2014 to allow additional

paving, and rising to $3.525 million in 2021.

Maintain the utility systems.

Service delivery interruptions minimized.

Flushed 150% of water system in 2013. Replaced 300

meters of aging cast iron water pipes. Over 450 life

expired water meters replaced in 2013. Over 1,600

backflow prevention devices tested in 2013. Replaced

45 meters of sanitary sewer and flushed 120 km of sewer

lines.

Maintain civic facilities

Extend the life of buildings and reduce

unplanned costly repairs.

Maintain regular major maintenance program and roof

inspection program for all civic facilities.

Maintain municipal fleet.

Repair and replacement program planned

and funded.

Vehicle Maintenance Management System in use.

Equipment Replacement Reserve Fund in balance.

Replaced aged items. Used 90 retreaded tires. 70 heavy

duty vehicles / equipment serviced and inspected

quarterly in 2013 and 90 light vehicles serviced.

Completed over 2000 repairs to fleet vehicles in 2013.

Manage Airport Lease.

Manage Airport Lease.

Compliance with Airport Head Lease and Operating

Agreement being maintained through timely

communications with Airport Operator. Issues are

being resolved as they arise resulting in no contractual

breaches. Completed concrete apron replacement in

2013. Global Navigation Satellite System (GNSS)

approach and departure procedures proposal has been

reviewed by Transport Canada and has been forwarded

to Nav Canada for final review and approval expected in

2014.

Objectives, Measures & Progress

25

2013 Annual Report