City of Chilliwack

Notes to Consolidated Financial Statements

Year Ended December 31, 2013

10

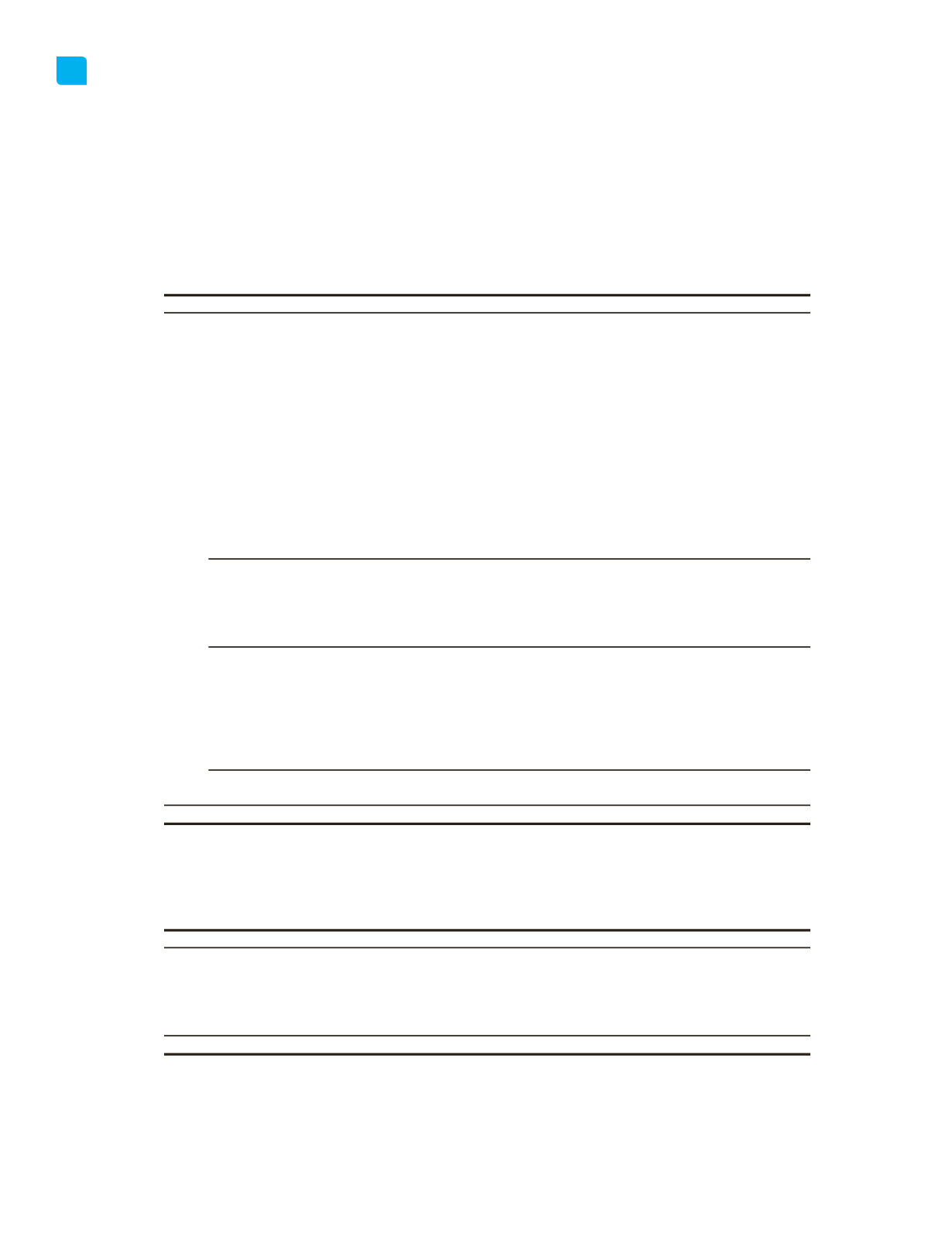

Accumulated Surplus:

Accumulated surplus consists of individual fund surplus, statutory reserves and surplus invested in tangible capital assets as follows:

2013

2012

Operating Funds

Unrestricted:

General

15,272,514

$

11,641,742

$

CEPCO

5,540,617

2,258,786

Tourism

412,274

379,489

Water Fund

2,450,000

2,350,000

Sewer Fund

2,360,000

2,210,000

Building - Protective Services

910,922

910,922

Landfill

4,897,202

5,922,712

Sewer future works

14,705,583

10,972,631

Water future works

9,599,820

8,176,534

Work-in-progress

3,076,800

2,865,000

Soil Removal

191,475

217,508

Other

1,603,004

2,430,730

61,020,211

50,336,054

Statutory Reserve Funds

General Capital

7,268,474

4,742,917

Equipment Replacement

2,736,722

2,834,281

Subdivision Control

671,632

614,807

10,676,828

8,192,005

Investment in Tangible Capital Assets & Property Under Development

General

380,158,183

374,045,032

Water

126,802,887

127,608,773

Sewer

157,812,265

161,536,316

CEPCO

8,304,990

10,190,542

Tourism

48,560

56,350

673,126,885

673,437,013

744,823,924

$

731,965,072

$

11

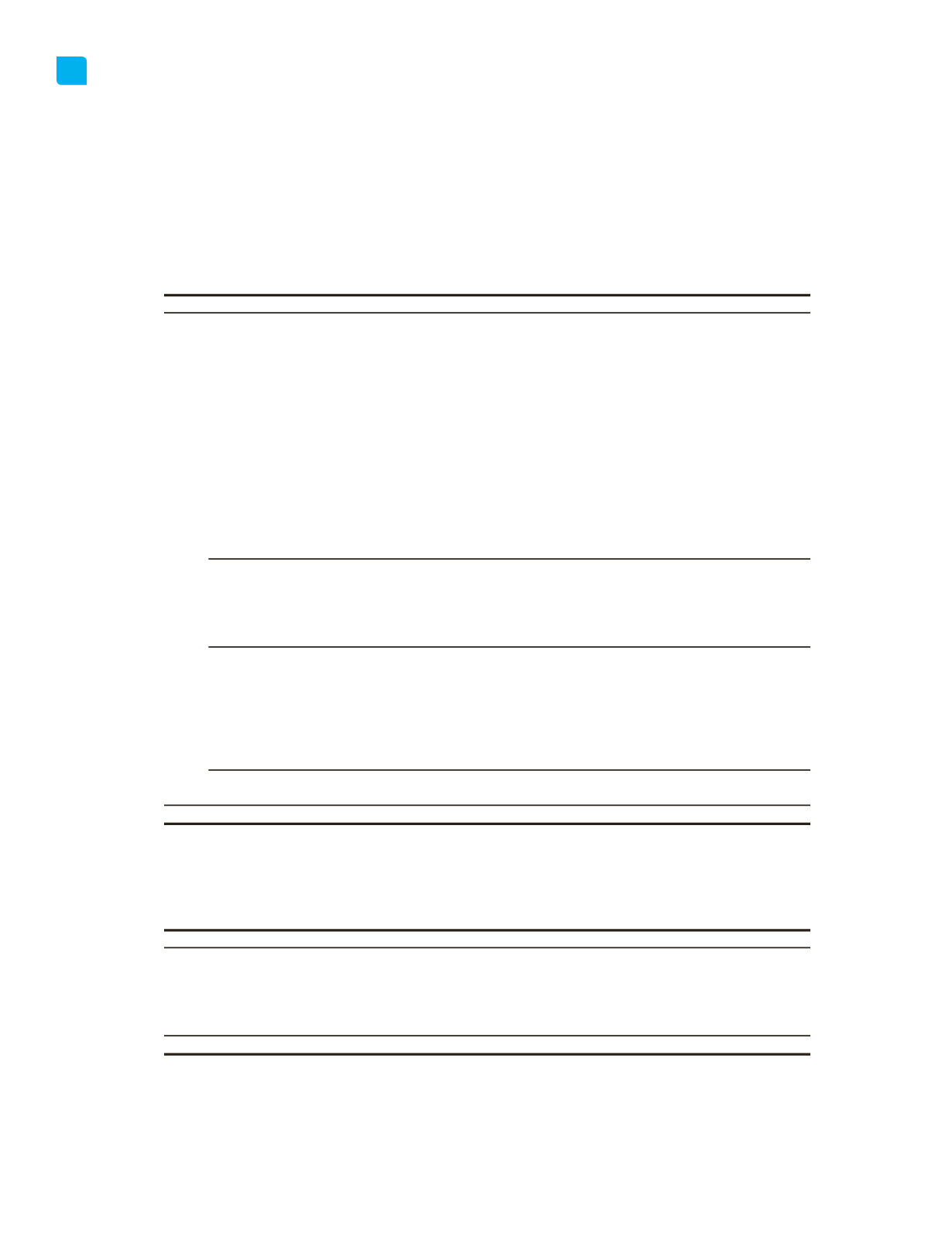

Collections for other governments:

The City collects and remits taxes on behalf of other government jurisdictions as follows:

2013

2012

B.C. Assessment Authority

844,124

$

836,009

$

Fraser Valley Regional Hospital District

3,009,972

3,010,417

Municipal Finance Authority

2,581

2,574

Ministry of Education

32,895,229

32,020,016

Fraser Valley Regional District

1,739,647

1,711,250

38,491,553

$

37,580,266

$

These taxes are not included in the Consolidated Statement of Operations of the City.

City of Chilliwack Financial Statements

52