City of Chilliwack

Notes to Consolidated Financial Statements

Year Ended December 31, 2013

(g)

Use of estimates:

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets

and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues

and expenses during the period. Significant estimates include assumptions used in estimating provisions for accrued liabilities, landfill

liability, contingent liabilities, and the estimated useful lives of tangible capital assets.

Actual results could differ from these estimates.

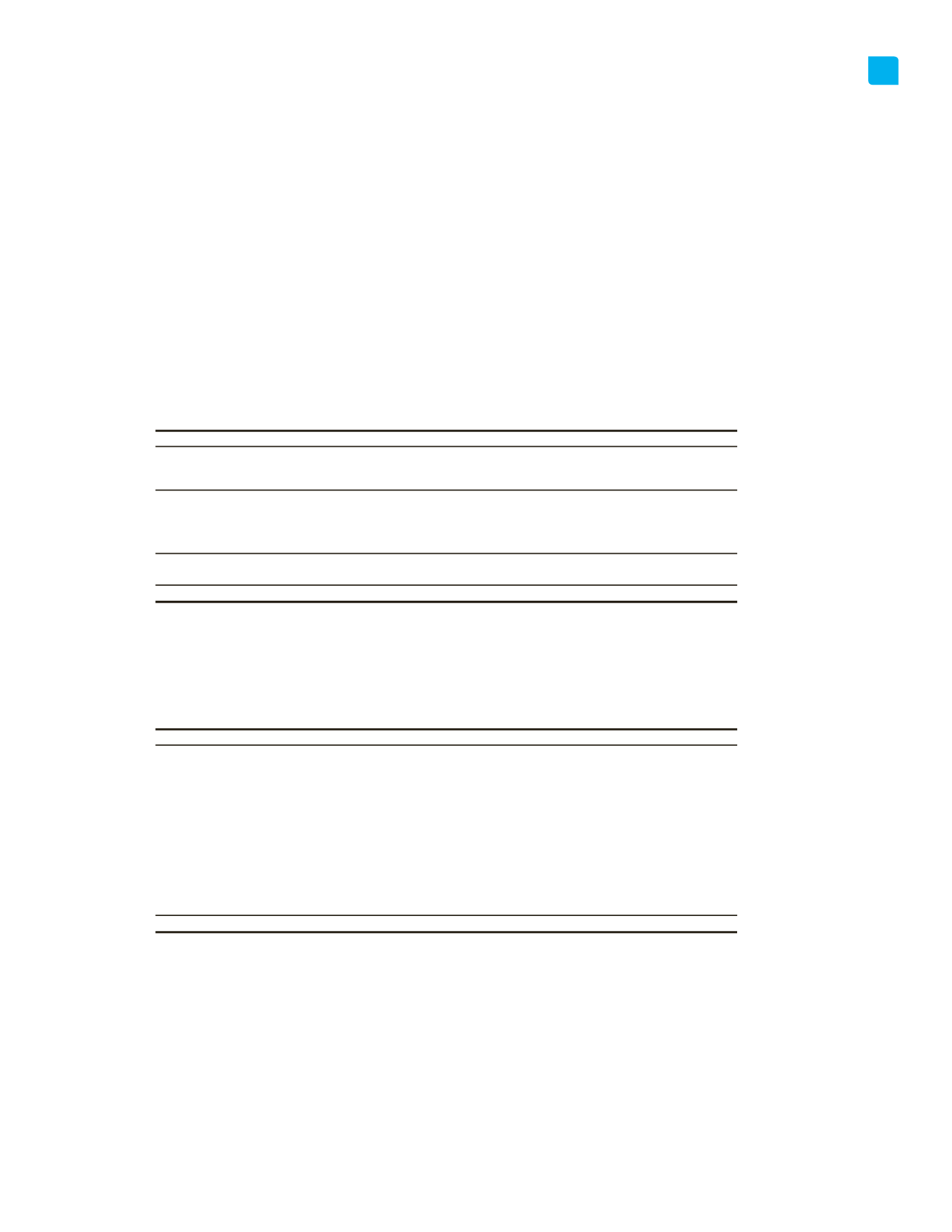

2

Restricted Assets:

The City has restrictions on the portfolio investments and cash available for operational use as follows:

2013

2012

Cash

25,334,855

$

22,063,899

$

Portfolio Investments

80,762,097

70,416,021

106,096,952

92,479,920

Less restricted for:

Statutory Reserve Funds

10,676,828

8,192,005

Restricted Revenue

24,984,956

22,032,730

35,661,784

30,224,735

Funds available for operational use

70,435,168

$

62,255,185

$

The investment portfolio includes bonds of chartered banks, the Government of Canada and provincial governments; deposits and notes of

chartered banks, credit unions, the Government of Canada and provincial governments; and deposits in the Municipal Finance Authority

short term investment pools.

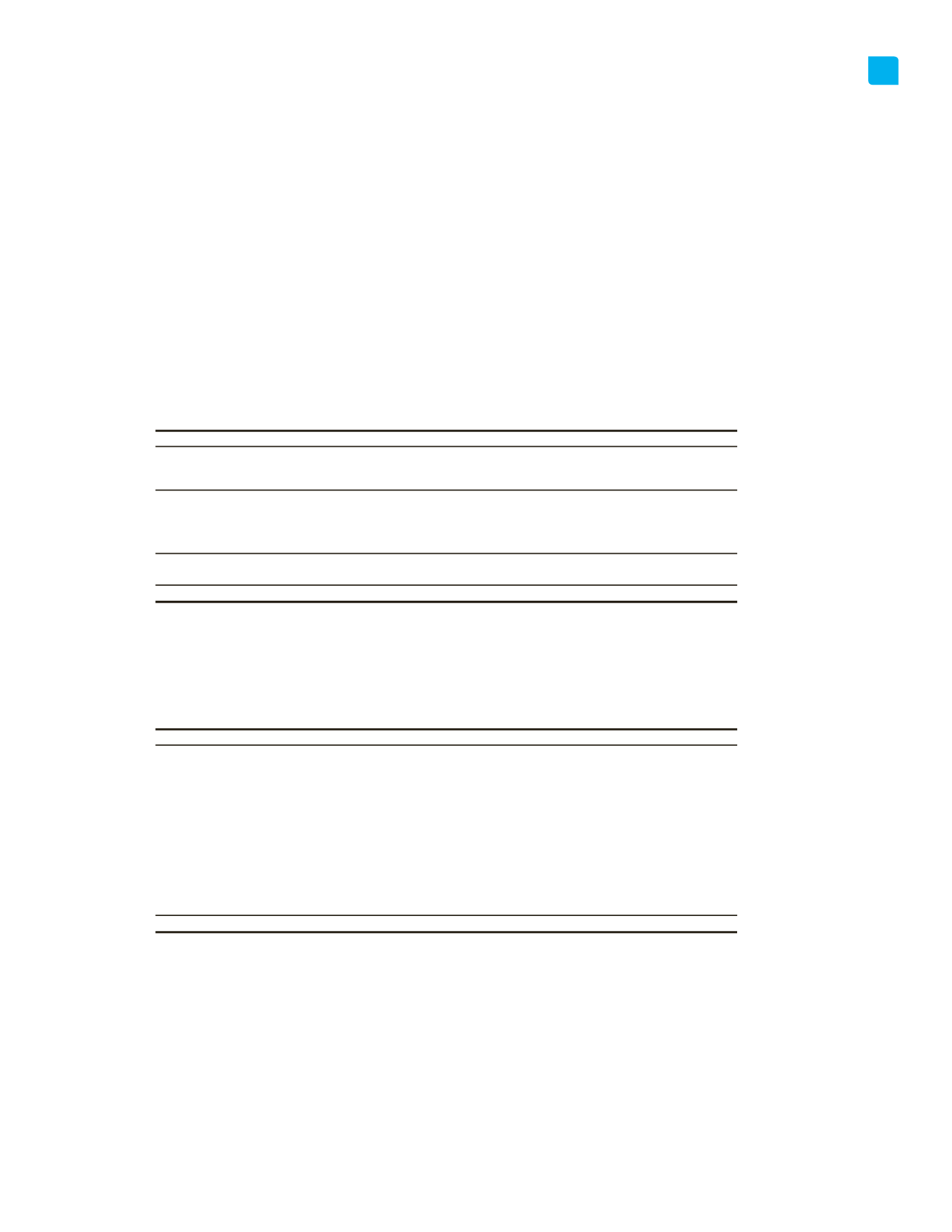

3

Accounts receivable:

2013

2012

Taxes

7,457,842

$

6,905,325

$

Province of British Columbia

3,029,770

243,104

Government of Canada

505,806

533,914

Regional and local governments

142,814

93,781

Trade receivables

2,325,114

2,518,361

Accrued interest

766,959

806,695

Tax sale properties subject to redemption

111,930

416,943

Water trade receivables

2,409,515

2,170,014

Sewer trade receivables

4,798,178

4,739,376

Development cost charges

3,010,048

1,843,734

24,557,976

$

20,271,247

$

City of Chilliwack Financial Statements

47

2013 Annual Report